By 2033, there will only be enough revenue to pay 79% of Social Security retirement benefits.

Americans’ #1 unaddressed concern for retirement is that Social Security will be reduced in the future.

PlanGap® Social Security protection helps offset reductions to your retirement benefits.

What is PlanGap?

PlanGap® Social Security protection helps offset reductions to your retirement benefits. PlanGap has pioneered “retirement insurance”. This is the first insurance product in history to protect your retirement income by paying you a bonus should your Social Security be reduced by government action. Protect your most valuable retirement income while earning a great interest rate on your savings.

What does it cost?

You decide how much you want to pay based on how much income you want to protect.

If you want to be in control of your Social Security, PlanGap may be right for you.

3 Distinct Benefits

Retirement Income Protection

PlanGap® Social Security protection helps offset reductions to your retirement benefits.

Peace of Mind

92% of Americans count on Social Security. Sleep better knowing your future is protected from uncertainty.

Tax-Deferred Growth

PlanGap Social Security protection is offered with annuities to help you prepare for a successful retirement.

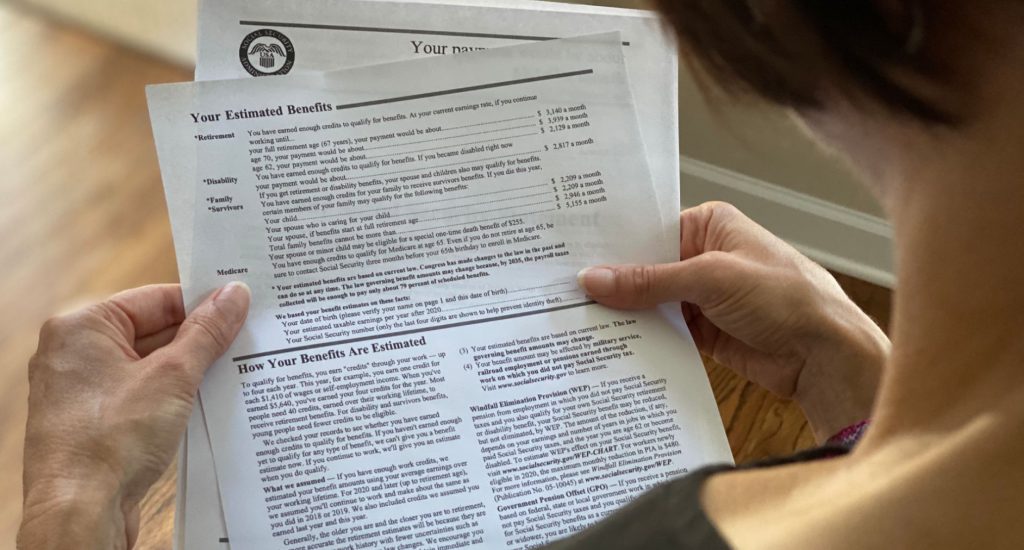

Social Security has disclosed that reductions are possible

Your estimated benefits are based on current law. Congress has made changes to the law in the past and can do so at any time. The law governing benefit amounts may change because, by 2033, the payroll taxes collected will be enough to pay only about 77 percent of scheduled retirement benefits.

The PlanGap Story

A letter from David Duley, Founder and CEO of PlanGap

The concept of PlanGap can be traced to a conversation I heard on a flight from Atlanta to Seattle. A couple, probably in their early 70’s, sat behind me and started talking about what would happen if the government cut their Social Security benefits. The concern in their voices resonated with me because it was similar to what I heard growing up in Flint, Michigan.

Most of my family and friends trusted and invested in General Motors to take care of them and provide for their retirement, but they learned the hard way that some promises can be broken. Imagining that GM would file for bankruptcy seemed crazy. The idea that GM would cut its workforce by almost 90% in Flint seemed impossible. Unfortunately, in the 1980’s many of the unimaginable scenarios began to happen to the citizens and businesses in Flint. In eerily similar ways, the fate of GM and Flint underscores what is at stake when we talk about Congress and the viability of Social Security for future retirees.

According to the 2024 Annual Report released by Social Security’s Board of Trustees, the program will only be able to cover 79% of promised retirement benefits by 2033. This is troubling since many Americans rely heavily on Social Security to maintain their standard of living in retirement. A 21% reduction in benefits would create a significant hardship for millions of Americans. In fact, the possibility of reduced Social Security benefits is now the largest unaddressed fear in retirement planning (19th Annual Transamerica Retirement Survey – December 2019).

It is hard to imagine that the promised benefits of Social Security could be reduced. But unlike the factory employees in Flint who were surprised by layoffs, Social Security is letting everyone know that reductions are possible. Take a look at your Social Security statement and the disclosure at the bottom of page two.

The reality is, I wish there wasn’t a need for PlanGap. But I know from personal experience the pain and suffering that comes when one counts on something that is promised and isn’t delivered. I have seen what it’s like to be helpless, worried and embarrassed. No one should have these feelings in their retirement years, especially when it comes to money.

We believe we are pioneering a new category of services – “retirement insurance” – and we’re doing this to protect Americans from the possibility of broken promises with Social Security, pensions and other retirement income sources. The response to this purpose has been overwhelming because it addresses what some have characterized as the new American Dream: Achieving retirement security.

My job and mission has been to bring together the world’s greatest innovators in finance and insurance to build a suite of products that help people regain control of their retirement plans. Not all of our product designs will fit the needs of everyone or be accessible to those who want this type of protection. That is the unfortunate truth of innovation. It will take time to develop additional products and bring the opportunity for retirement protection to more people, but we are committed to making that happen.

In 2020, we started with our annuity design that pays a bonus should Social Security benefits be reduced by government action. In an historic first, it is the only insurance product to provide a benefit based upon a reduction in Social Security. In the months to come, as we partner with some of the largest insurance and financial institutions in the world, we plan to roll out additional products at varying price points and protection levels.

PlanGap was built to put people back in control so they can enjoy peace of mind knowing their retirement income is protected from broken promises.

My message to America’s current and future retirees is this: You’ve done your part, now let PlanGap help protect what you’ve earned and what is owed to you.

To share ideas, innovations or ways we can better advance protections for retirees, please reach out to me directly. We are all in this together.

Testimonials

I didn’t know I could get protection for my Social Security!

Tracy D.

Illinois

The only thing that could derail my retirement plan is if Social Security is reduced.

Jason B.

Michigan

With PlanGap, I have one less thing to worry about in my retirement.

Kate E.

Colorado

Social Security is an important part of my retirement income. But now that I have PlanGap, I don’t have to be concerned about it getting cut.

Mary C.

Arizona

I’m already means-tested for Medicare, I couldn’t imagine if they did that to my Social Security. I am so glad I am protected with PlanGap.

Lisa N.

Ohio

No one knows what is going to happen to Social Security. But if they change the rules, PlanGap will help me preserve what was promised to me.

Michael J.

Louisiana